As the adoption of digital assets continues to steadily increase, more companies have begun to use digital assets within global commerce. Businesses worldwide are increasingly adopting digital assets like Bitcoin to facilitate international transactions, reducing their reliance on traditional currencies, and navigating economic challenges.

This article explores the growing integration of cryptocurrencies in global commerce, the incentives driving their adoption, and we provide some real-world examples illustrating this financial evolution.

1. Cryptocurrency's Role in Global Trade

Cryptocurrencies offer several advantages that make them attractive for international business transactions:

- Decentralization: Operating without central authority, cryptocurrencies enable direct peer-to-peer transactions, reducing intermediaries and associated costs.

- Speed and Efficiency: Cross-border transactions with cryptocurrencies can settle in minutes, compared to traditional banking systems that may take days.

- Reduced Currency Dependence: Utilizing digital assets can mitigate risks associated with currency fluctuations and reliance on specific national currencies.

In a detailed comparison by a16zcrypto, we can see that stablecoins are significantly cheaper to conduct on a large scale— relative to all of the alternative options.

2. Increasing Incentivization for Businesses to Adopt Cryptocurrency

There are several factors that are encouraging businesses to integrate cryptocurrencies into their operations:

- Tax Benefits: Some jurisdictions are now proposing tax incentives to promote cryptocurrency adoption. For instance, recent proposals in the United States aim to create tax-free environments for certain crypto transactions, encouraging businesses to embrace digital assets.

- Favorable Regulatory Environments: Countries like the United Arab Emirates have established supportive frameworks for cryptocurrency integration, fostering innovation and attracting crypto-centric businesses.

- Access to New Markets: Accepting cryptocurrencies can open businesses to a global customer base that prefers or exclusively uses digital assets.

3. Real-World Examples of Cryptocurrency in Business

The following cases illustrate how businesses and nations are leveraging cryptocurrencies:

- SpaceX's Starlink Adopts Stablecoins: SpaceX has begun accepting stablecoins as payment for its Starlink satellite internet services, streamlining transactions and catering to tech-savvy customers.

- Bolivia's YPFB Turns to Crypto for Energy Imports: Facing a shortage of U.S. dollars, Bolivia's state energy firm YPFB has implemented a system to use cryptocurrencies for purchasing fuel imports, ensuring energy supplies amid currency constraints.

- Major retailers like Newegg, Overstock, and Shopify are embracing cryptocurrency payments, allowing customers to seamlessly transact using Bitcoin, Ethereum, and stablecoins through platforms like BitPay and Coinbase Commerce. In 2024 alone, Bitpay processed over 608,000 transactions.

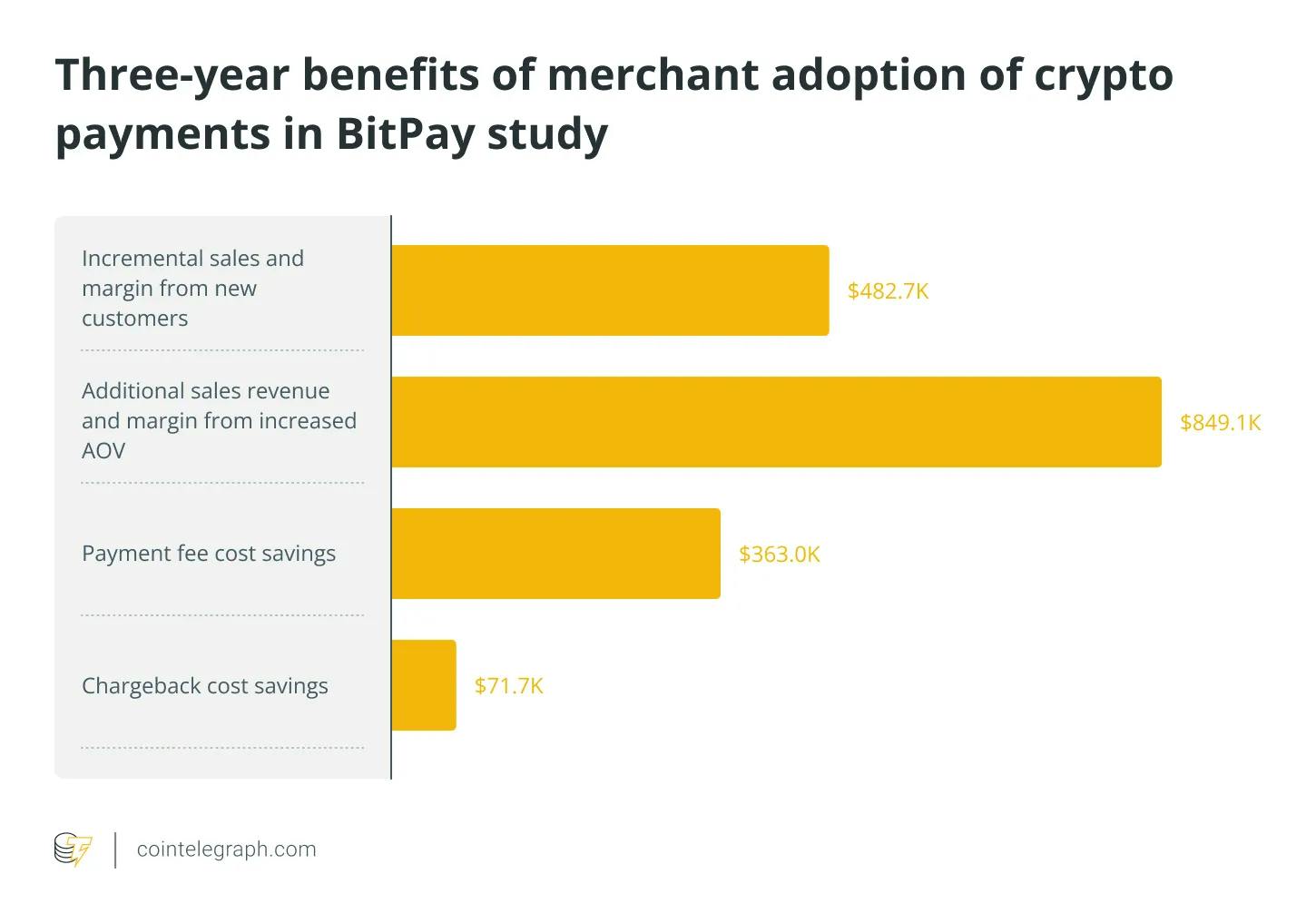

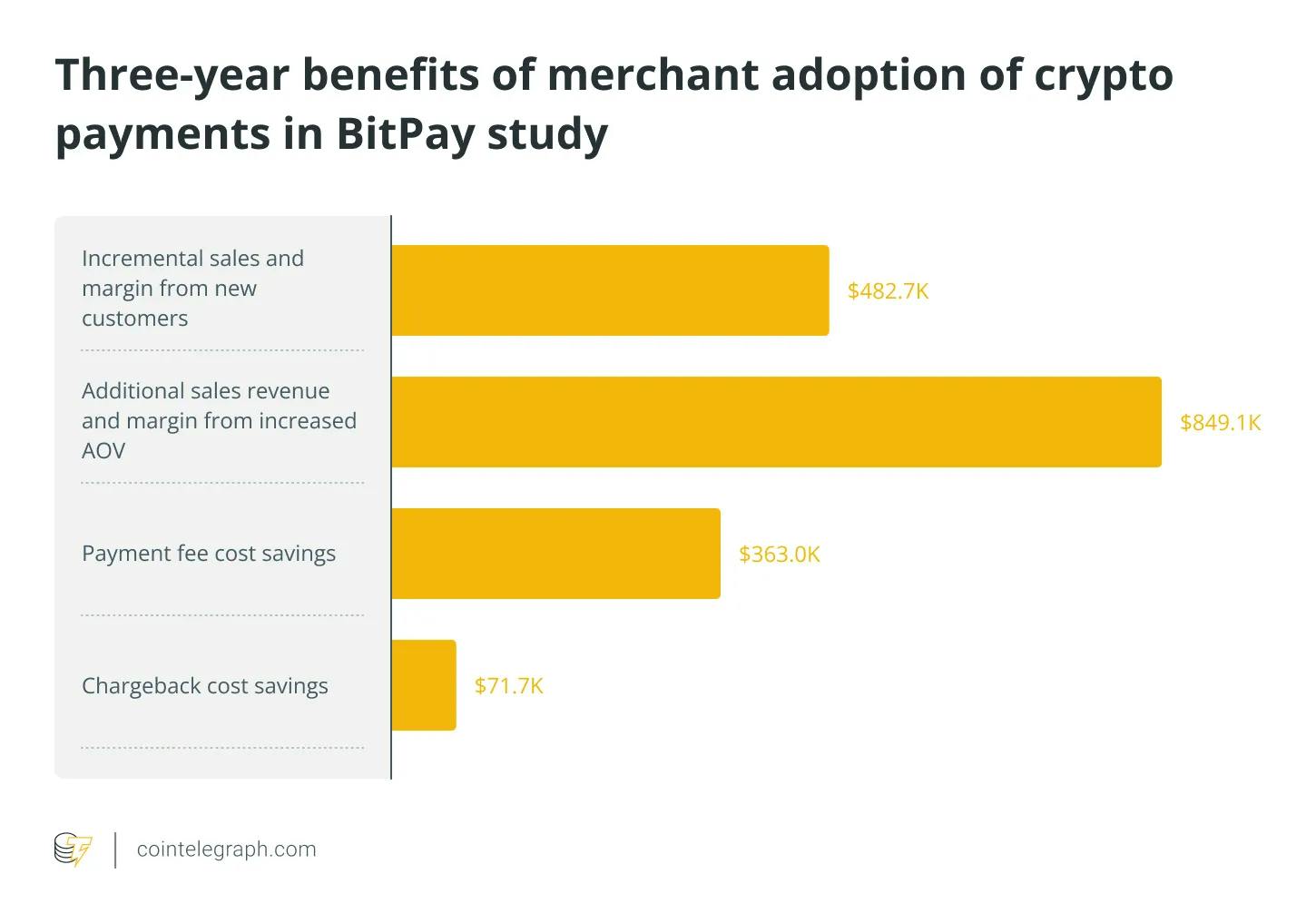

A study conducted by Bitpay was able to show that businesses that accepted crypto payments actually saved money. Chart by CoinTelegraph

4. Fintech Companies Leading Stablecoin Adoption

Fintech firms are at the forefront of stablecoin adoption, leveraging digital assets to enhance global payments and financial services:

- PayPal and PYUSD: PayPal launched its own stablecoin, PYUSD, to enable seamless transactions and merchant payments within its ecosystem.

- Stripe and Stablecoin Payments: Stripe has integrated stablecoins to facilitate cross-border payments, providing businesses with an efficient alternative to traditional remittance methods.

- Revolut’s Crypto Integration: The European fintech giant Revolut allows users to send and receive payments in stablecoins, offering an additional layer of financial flexibility.

- Circle and USDC Expansion: Circle’s USDC stablecoin is gaining traction among businesses for its transparency, liquidity, and reliability in international transactions.

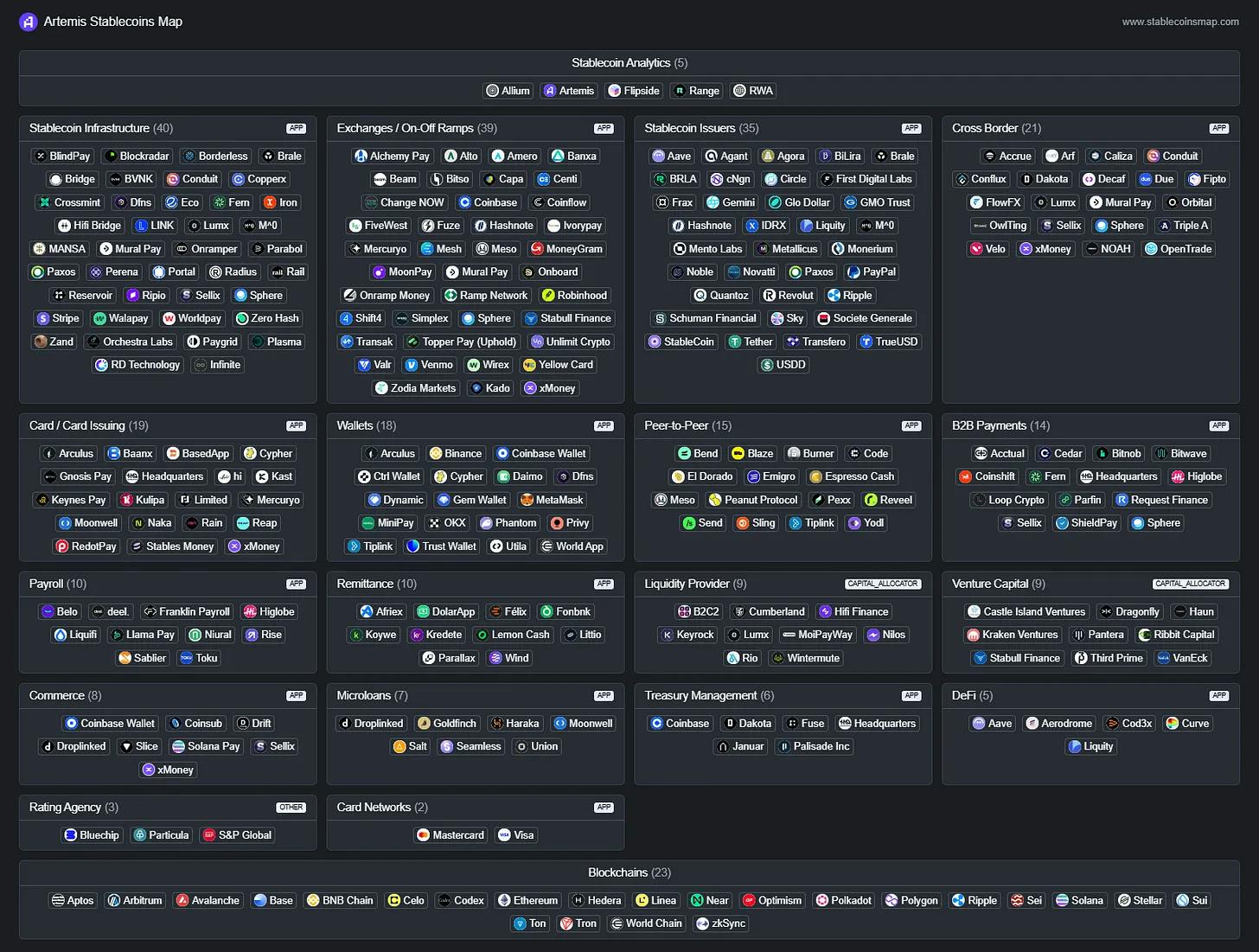

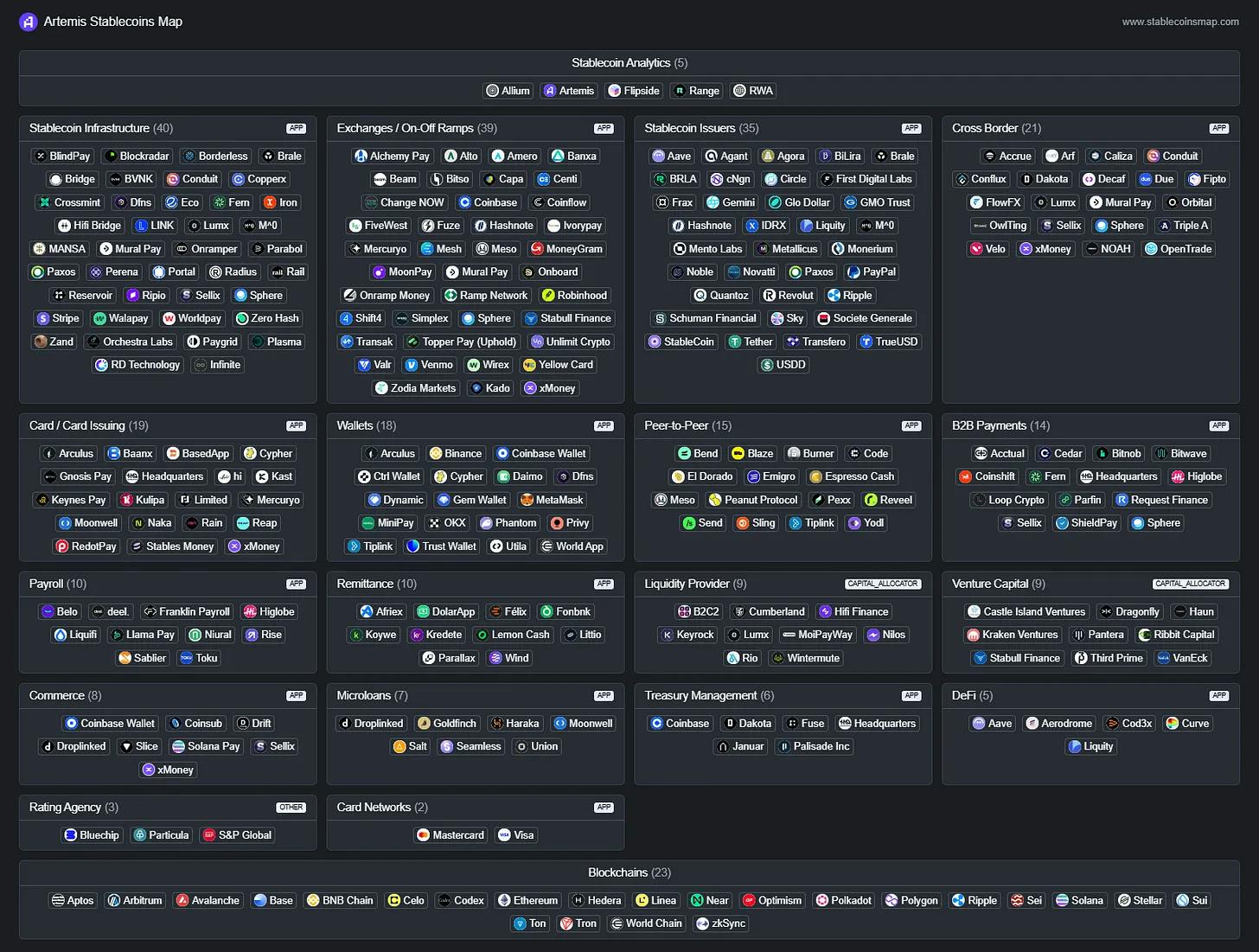

There has never been more companies involved in the stablecoin space. It is projected that this area will continue to grow, especially now that the conditions have become more favorable for stablecoin issuers. Data via Artemis

Follow us on LinkedIn to receive push notifications on our latest posts.