A digital asset

investment fund

Viska Funds aim to capture opportunities in the interplay between emerging technologies, hard assets, and the infrastructure of the future.

Viska Funds aim to capture opportunities in the interplay between emerging technologies, hard assets, and the infrastructure of the future.

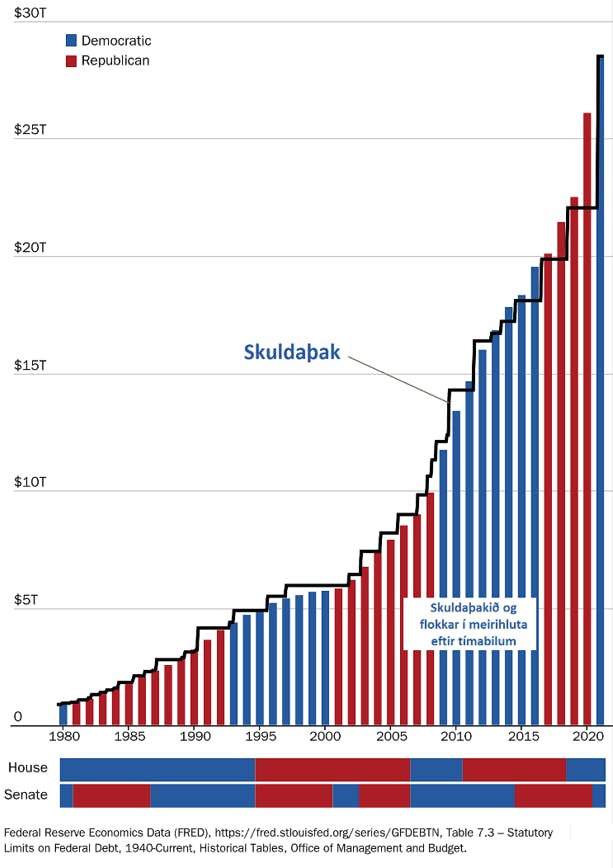

There has been considerable discussion about the US government's debt ceiling. The debt ceiling is the amount the US government is legally allowed to owe. To increase the debt beyond this limit, a law change is needed to raise the debt ceiling. The US government is expected to run a deficit of around 1.5 trillion dollars this year, and forecasts predict that the deficit will double as a percentage of GDP over the next 30 years (Congressional Budget Office). The US government has financed its deficit spending by issuing a substantial amount of government bonds. The deficit has persisted every year since 1970 (except for 1998-2001). As a result, the US government has relied on external financing as tax revenues and other government income do not cover government expenditure. However, the current situation is that further debt can only be issued if the government has reached the existing debt ceiling of about 31.4 trillion US dollars. Therefore, the government's liquid assets are approaching historically low levels, as shown in the figure below (Treasury General Account). In June, the US government's liquid assets will likely run out if a debt ceiling increase is not agreed upon before then.

Analysts expect existing liquid assets to last until June 1 - 12. By then, an agreement in Congress must have been reached, but according to sources, more disagreement still exists between parties. It should be noted that raising the debt ceiling has historically been a prominent political bone of contention between parties, where the opposition has tried to pass other issues through Congress along with raising the debt ceiling. Therefore, these issues often get delayed in Congress, and sometimes no agreement is reached until many weeks after the US government's liquid assets have run out. Then the government is forced to shut down institutions and even delay salary payments to public employees, which bites into the service and operations of the government. For example, the US government's credit rating was lowered under these circumstances in 2011, causing considerable market shock. When institutions were shut down at the turn of 2018-2019, after no consensus was reached on raising the debt ceiling, stock markets dropped by 17% over three weeks. Thus, these events often cause significant unrest as the discussion shifts toward the US government's ever-increasing debt.

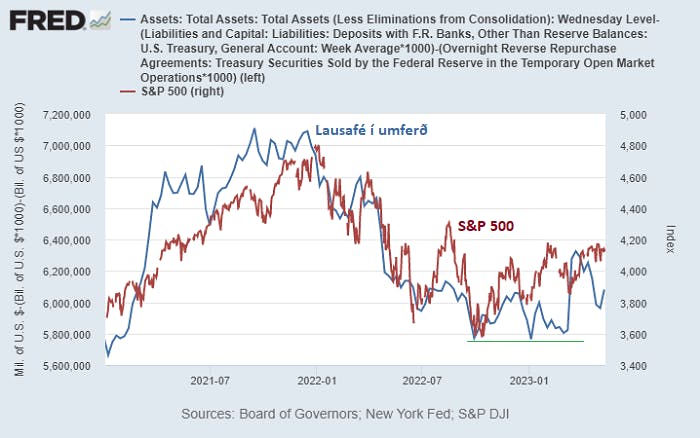

In the end, an agreement will likely be reached, and the debt ceiling will be raised. However, there is more to the story because the US government must replenish its liquid assets. That will involve a significant issue of US government bonds, which, all other things being equal, will significantly reduce market liquidity. The US Treasury aims to have about 500 - 600 billion US dollars in liquid assets. In addition, about 300 billion needs to be repaid by the US government (extraordinary measures). In addition, the supply of US Federal Reserve (FED) bonds will increase as they reduce their bond holdings by an average of 95 billion US dollars per month (QT). Therefore, these scenarios could have significantly adverse effects on market liquidity, which has generally correlated well with the asset market in recent years (see figure below).

A question remains of how will the US Treasury seek to replenish these funds. Will the Treasury mainly issue Treasury bills rather than longer-term bonds? Will foreign parties come to the table and finance the US government as they have over the past decades? However, there was a significant change last year when the largest foreign holders of US government bonds sold a substantial amount. Will the FED re-enter the market by reducing their bond supply or buying government bonds again as they have done most years since 2008?

This picture will quickly become clear this summer, and markets have been calmer. However, in the coming weeks, the US government will reach its limits, and markets will want a resolution to these issues. Will this lead the FED to change its policy, stop QT, and start repurchasing government bonds, or does something in the system need to give for a policy change?